/ Return on investment /

I.e. in total 0 € (gross) according to to the project owner’s forecast:

| Year |

0 € |

0 € |

0 € |

0 € |

0 € |

x... your initial investment (i.e. + ... %)

* Tax: Flat tax of 30% on the profit if you declare your income in France. Otherwise, your local tax law applies.

/ Presentation /

Read more

Pitch

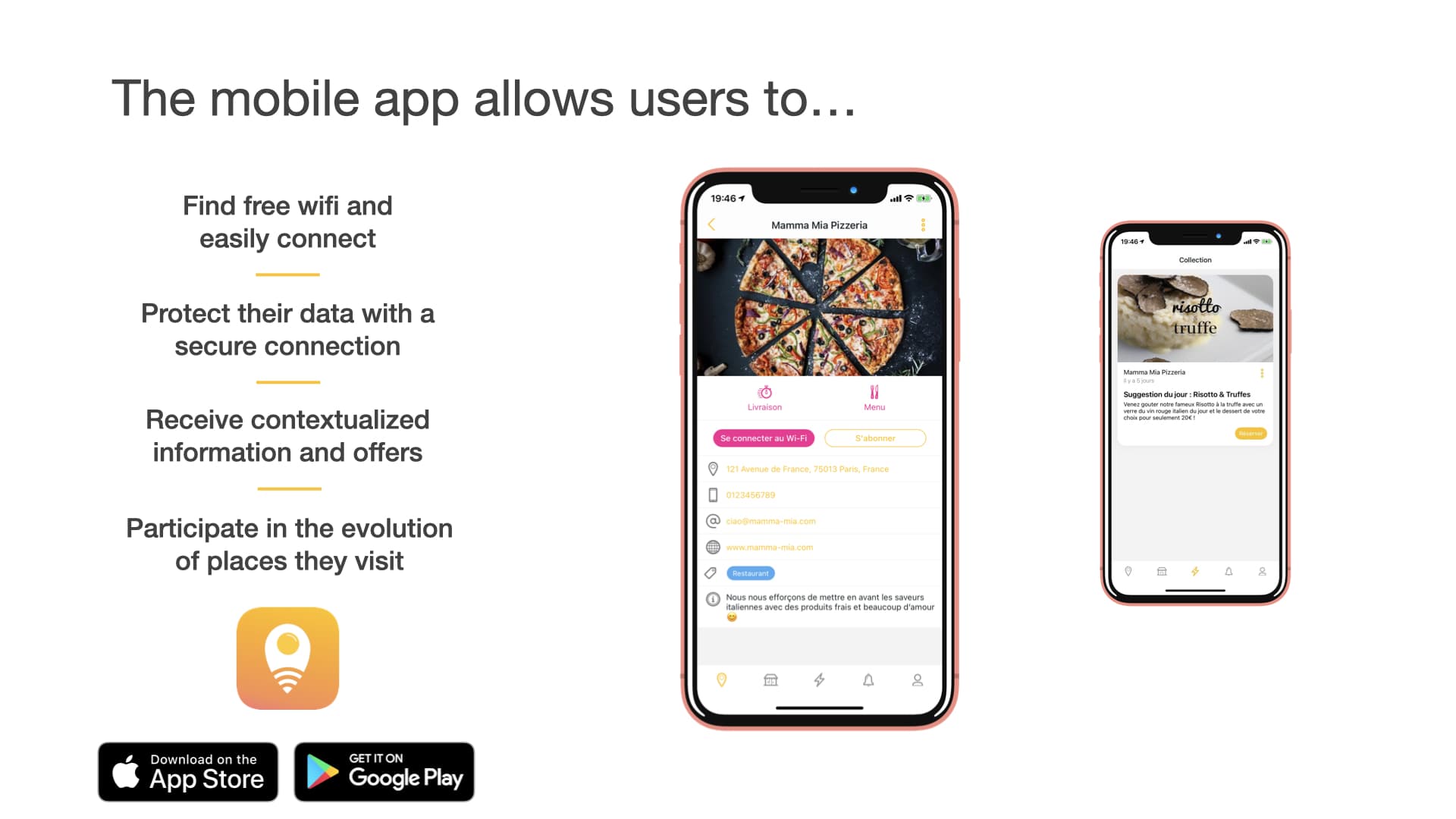

Example of commercial video for merchants

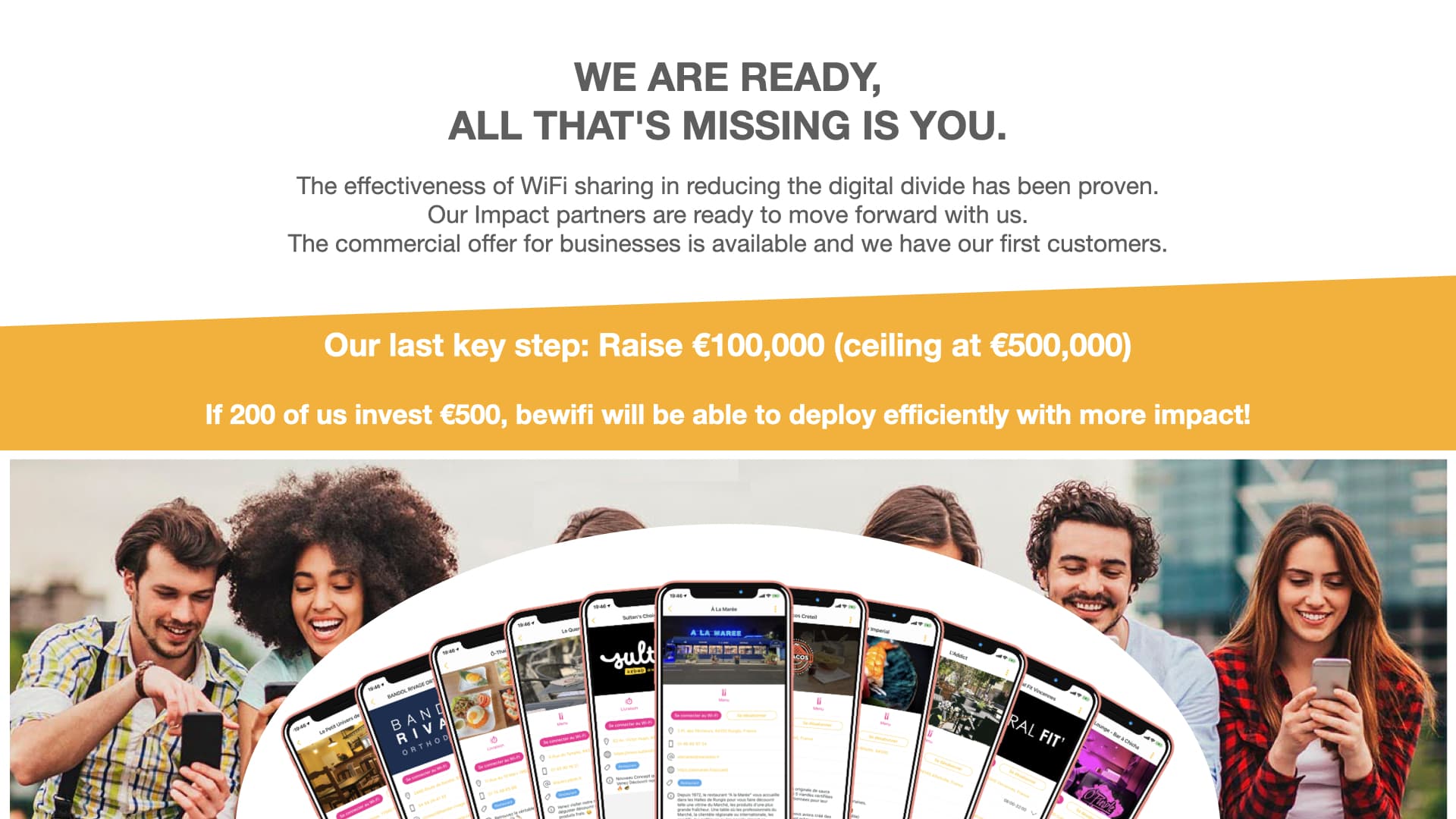

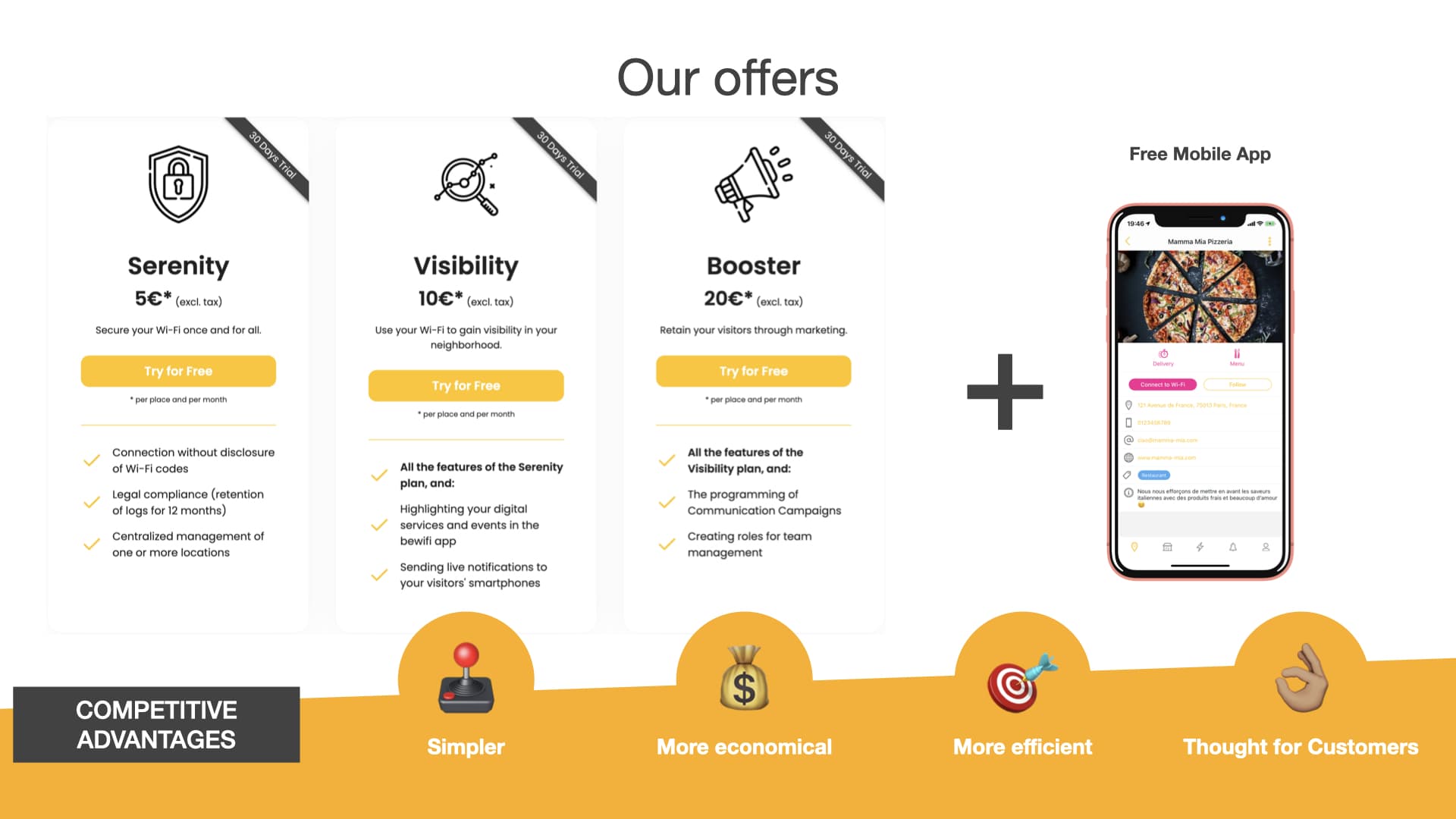

All investors will receive 3% of turnover for €500,000 (maximum) invested. Your share will be proportional to your investment.

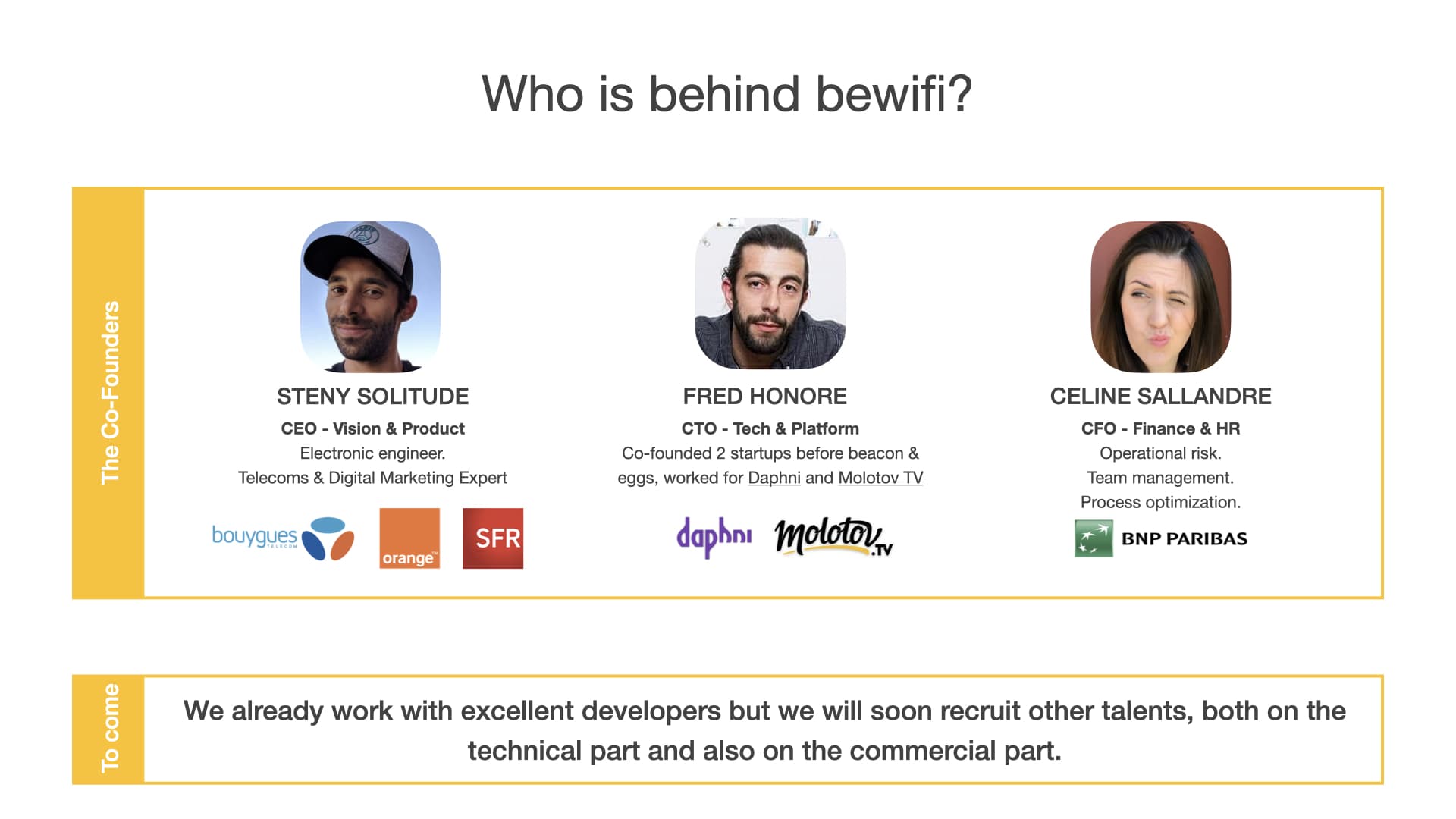

STRUCTURE: beacon & eggs is an SAS created in 2017, with share capital of €30,000. It is represented by Steny Sylvain SOLITUDE who holds 39% of the company’s shares.

Financial data

Target profitabilityx3,00 en 5 ans (+200,00 % raw)Risk of full loss of investment, maximum gain: x3 Minimum gain as long as the company is in business: x1,15 |

Royalties paid quarterly5,00 % maximum% of turnover paid to all investors, for 500 000,00 € raised, proportional to the amount raised |

Revenues and funding project

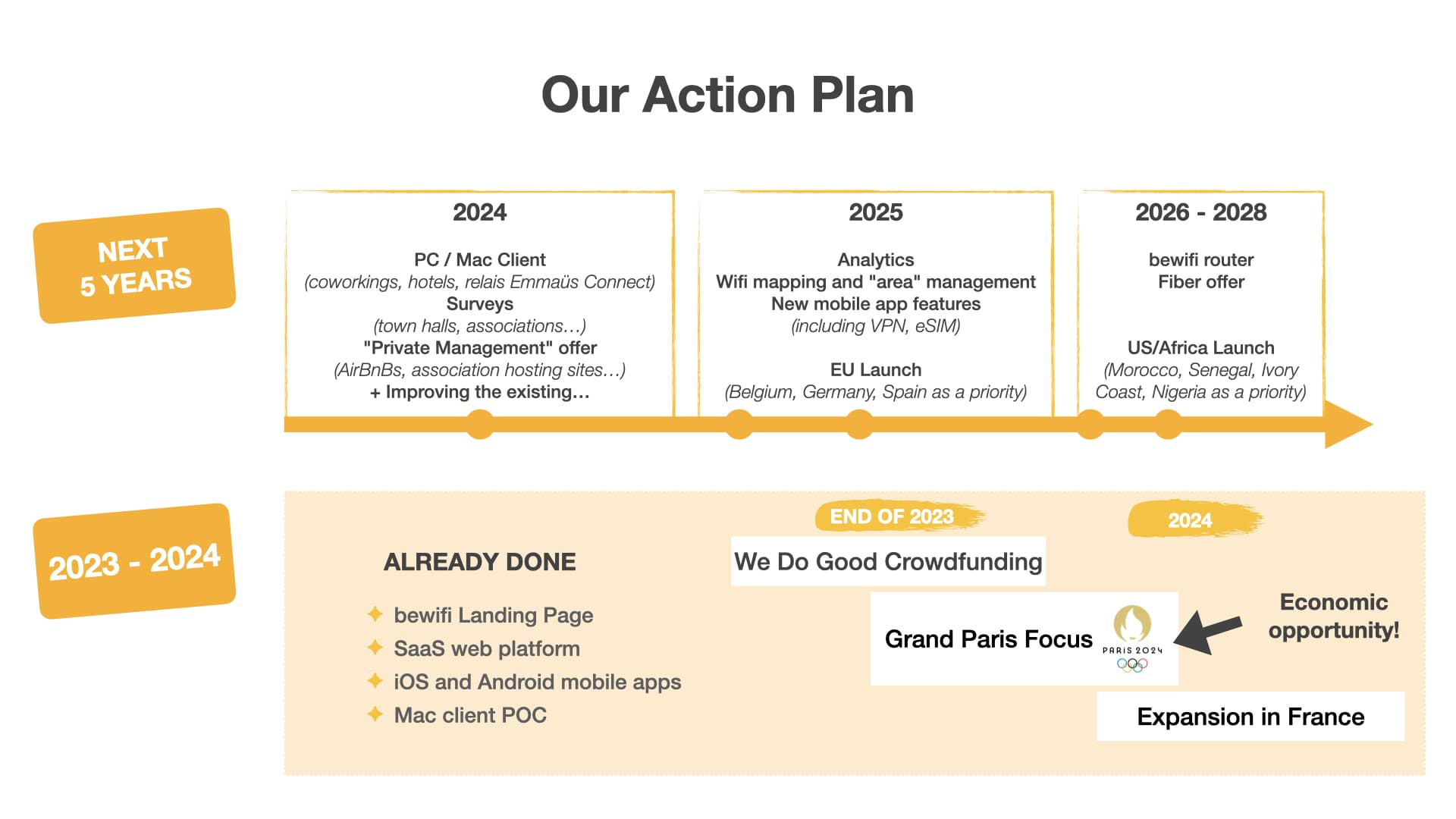

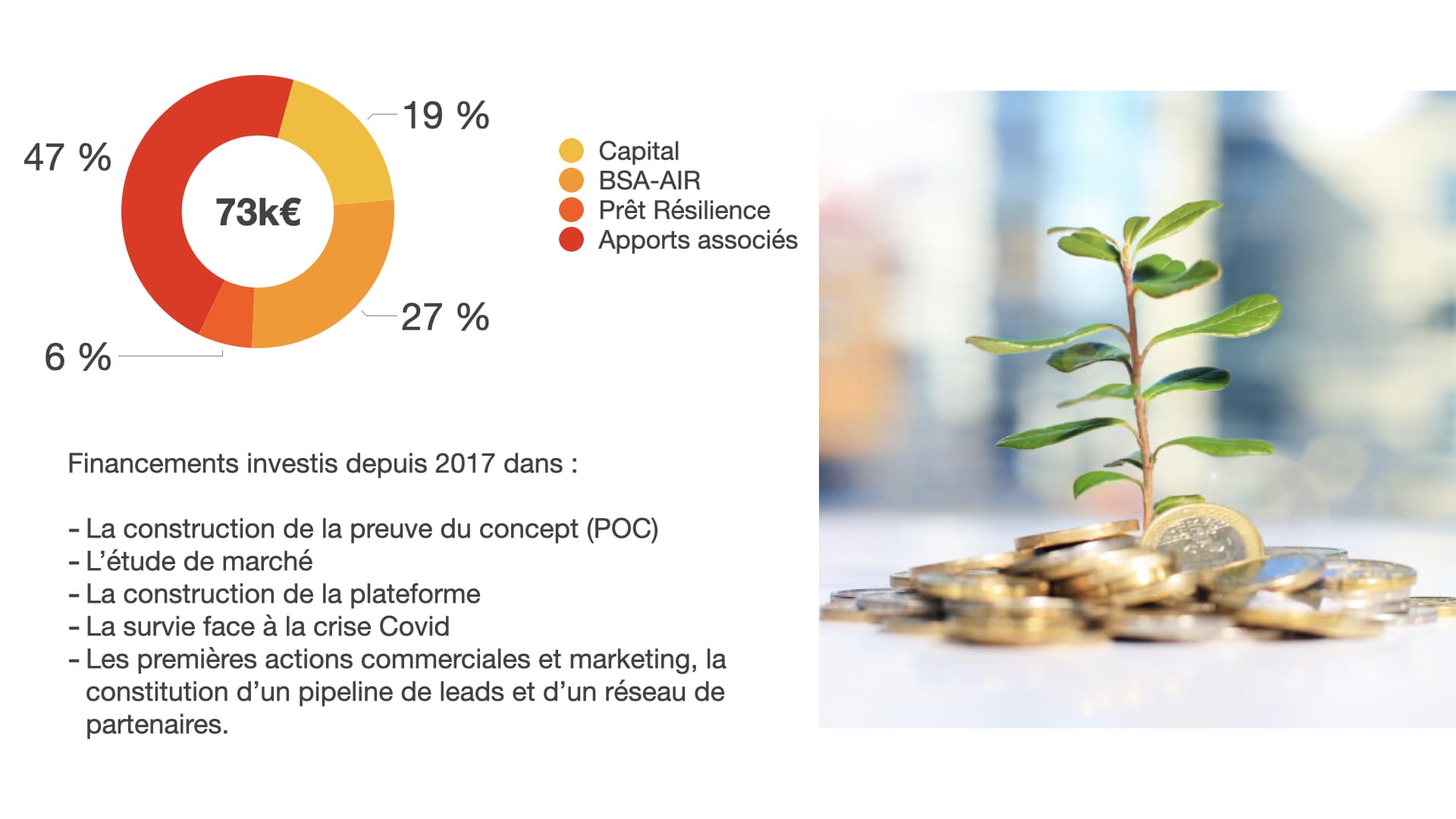

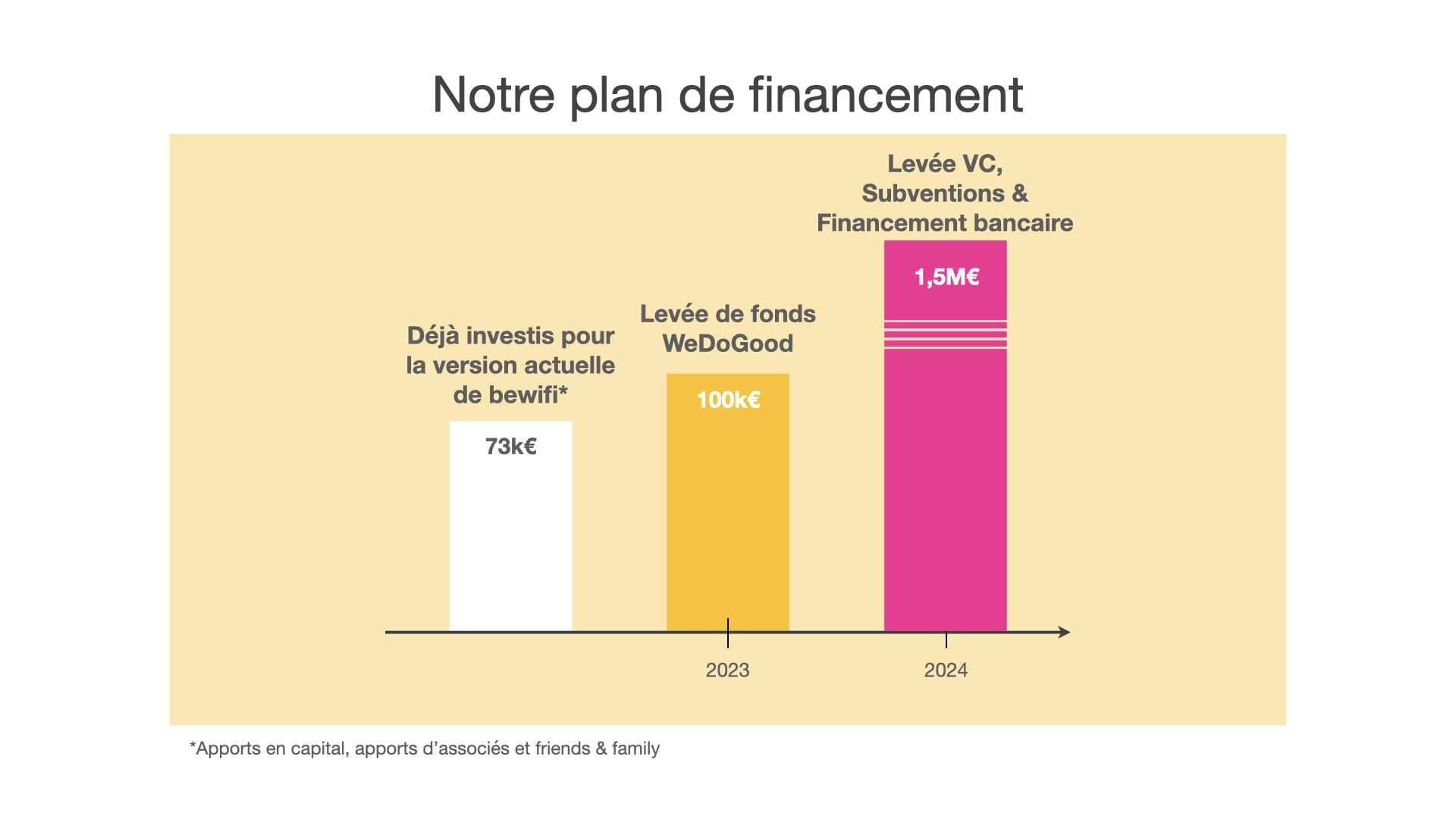

We have already gathered 73 000,00 €

Over the 12 months preceding the fundraising, we achieved 28 510,00 € in turnover.

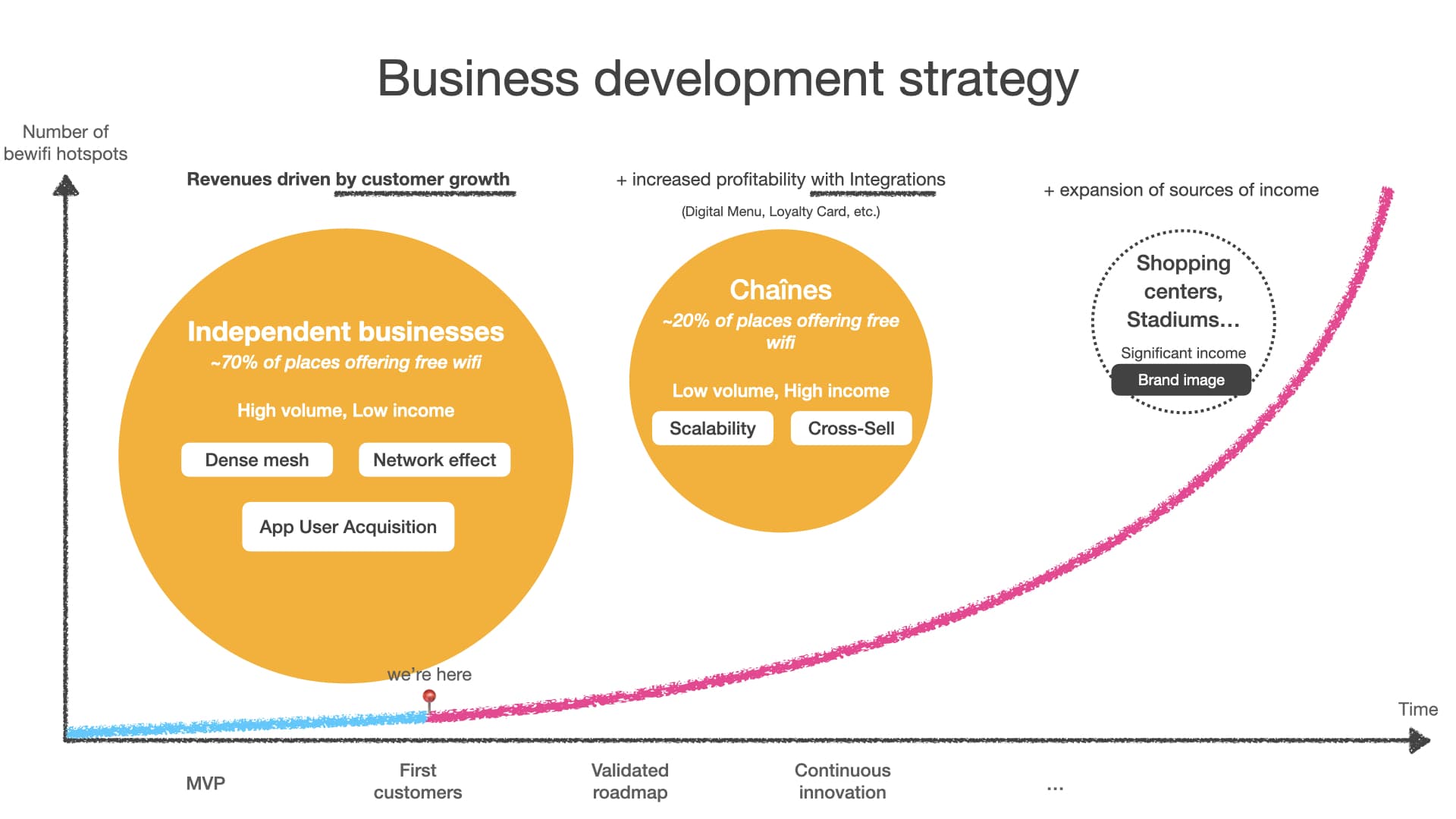

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Number of sales | 7551 | 25369 | 59643 | 199390 | 1098086 |

| Projected revenue | 288 000,00 € | 1 533 000,00 € | 3 986 000,00 € | 11 537 000,00 € | 55 458 000,00 € |

Your investment

By investing, you subscribe to beacon & eggs for a royalty on the company's turnover, proportional to your investment. The total investors will receive 5,00 % from the turnover achieved each year for a fundraising of 500 000,00 €.

If beacon & eggs realizes its forecast, the return for each investor will be 200,00 % gross to 5 years.

Calculate my return

What happens if the forecast is not reached?

In the event that the forecast is not reached after 5 years and the activity continues, beacon & eggs will continue to pay the royalties until a return of 1,15 times the amount invested is reached.

When do payments start?

The Royalty is transferred over a period of 5 years from 01/04/2024 and will be paid to investors on a quarterly basis.

All these elements will appear in your contract during the investment.

Provisional payment schedule

Attention: these figures are based on an estimate of our turnover. It's up to you to evaluate the forecast and the strategy to estimate whether you can expect to earn more or less than the announced annual return.

| Estimated compensation on income of: | Date of payment |

|---|---|

| 2024 | |

| April, May, June | 15/07/2024 |

| July, August, September | 15/10/2024 |

| October, November, December | 15/01/2025 |

| 2025 | |

| January, February, March | 15/04/2025 |

| April, May, June | 15/07/2025 |

| July, August, September | 15/10/2025 |

| October, November, December | 15/01/2026 |

| 2026 | |

| January, February, March | 15/04/2026 |

| April, May, June | 15/07/2026 |

| July, August, September | 15/10/2026 |

| October, November, December | 15/01/2027 |

| 2027 | |

| January, February, March | 15/04/2027 |

| April, May, June | 15/07/2027 |

| July, August, September | 15/10/2027 |

| October, November, December | 15/01/2028 |

| 2028 | |

| January, February, March | 15/04/2028 |

| April, May, June | 15/07/2028 |

| July, August, September | 15/10/2028 |

| October, November, December | 15/01/2029 |

| 2029 | |

| January, February, March | 15/04/2029 |

Risk factors

Key risk factors related to the activity and project

Risk related to the financial situation of the company

Currently, prior to the completion of the fundraising of this offer, the company Has, with sufficient net working capital to meet its obligations and cash flow needs for the next 6 months.

Sources of funding under consideration in connection with the project presented for the next 6 months:

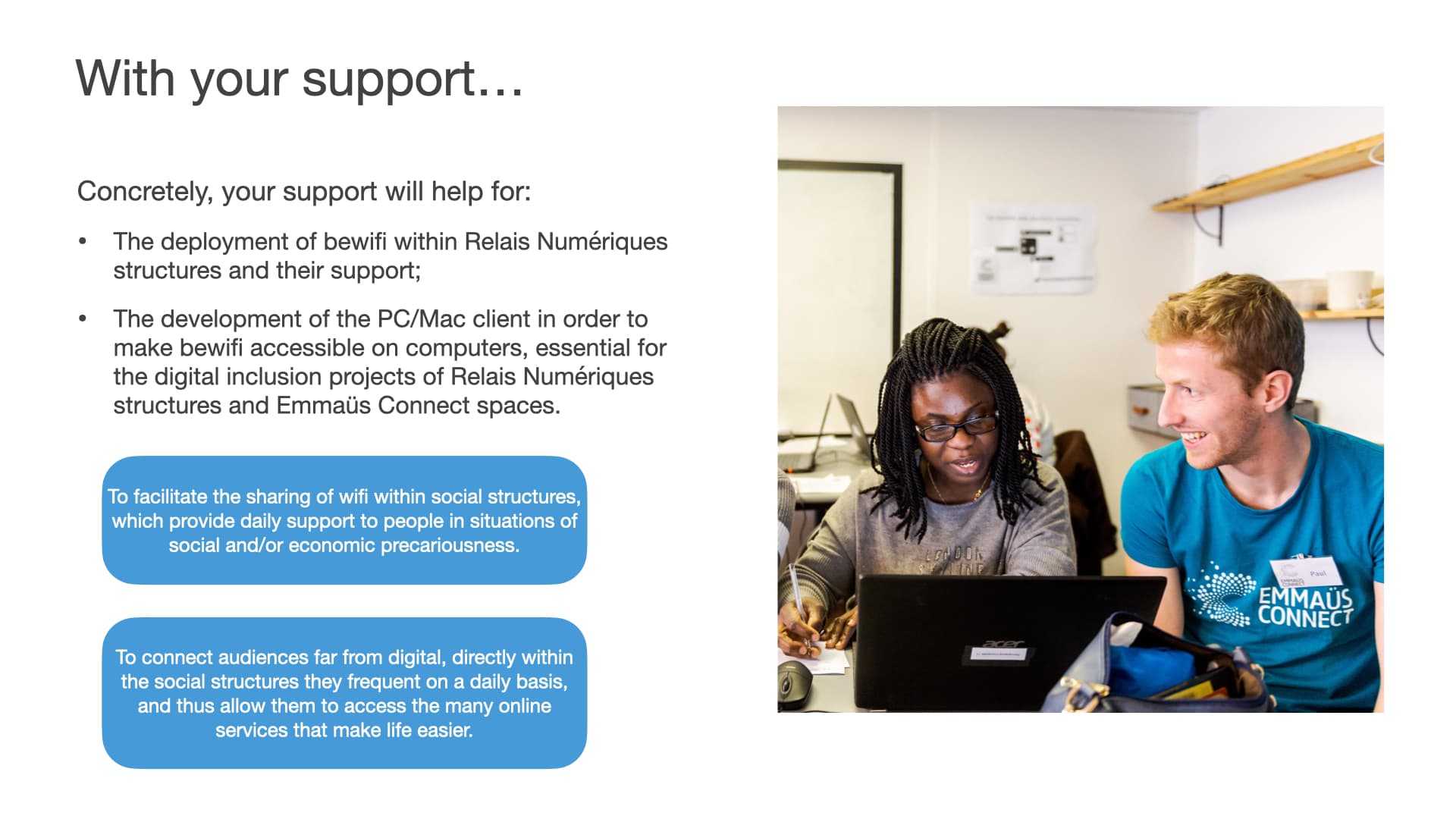

Notre objectif avec cette levée de fonds We Do Good est donc d'avoir les moyens d'accélérer l'activité de manière pérenne pour être en position dominante afin de faire une levée de fonds plus conséquente auprès de fonds d'investissements en capital-risque à horizon 2024.

Cela nous permettra de privilégier un partenaire financier qui partage nos valeurs comme certains fonds à impact avec lesquels nous avons déjà eu de premiers échanges.

Cette levée sera complétée par du financement public à l'innovation via BPI France.

Pour finir nous ferons appel à du financement bancaire plus classique pour compléter la levée.

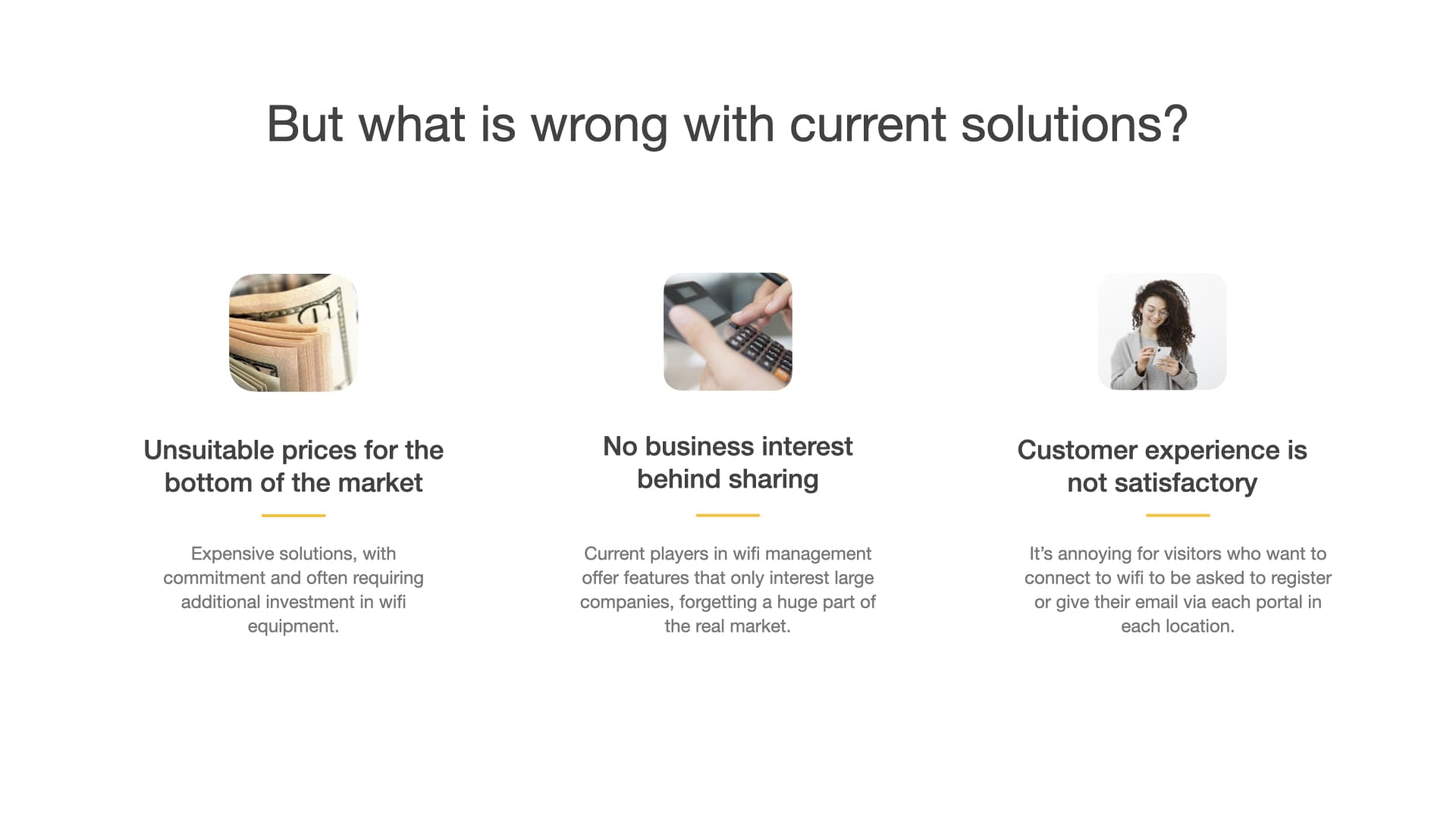

Risque lié à l'activité de la société

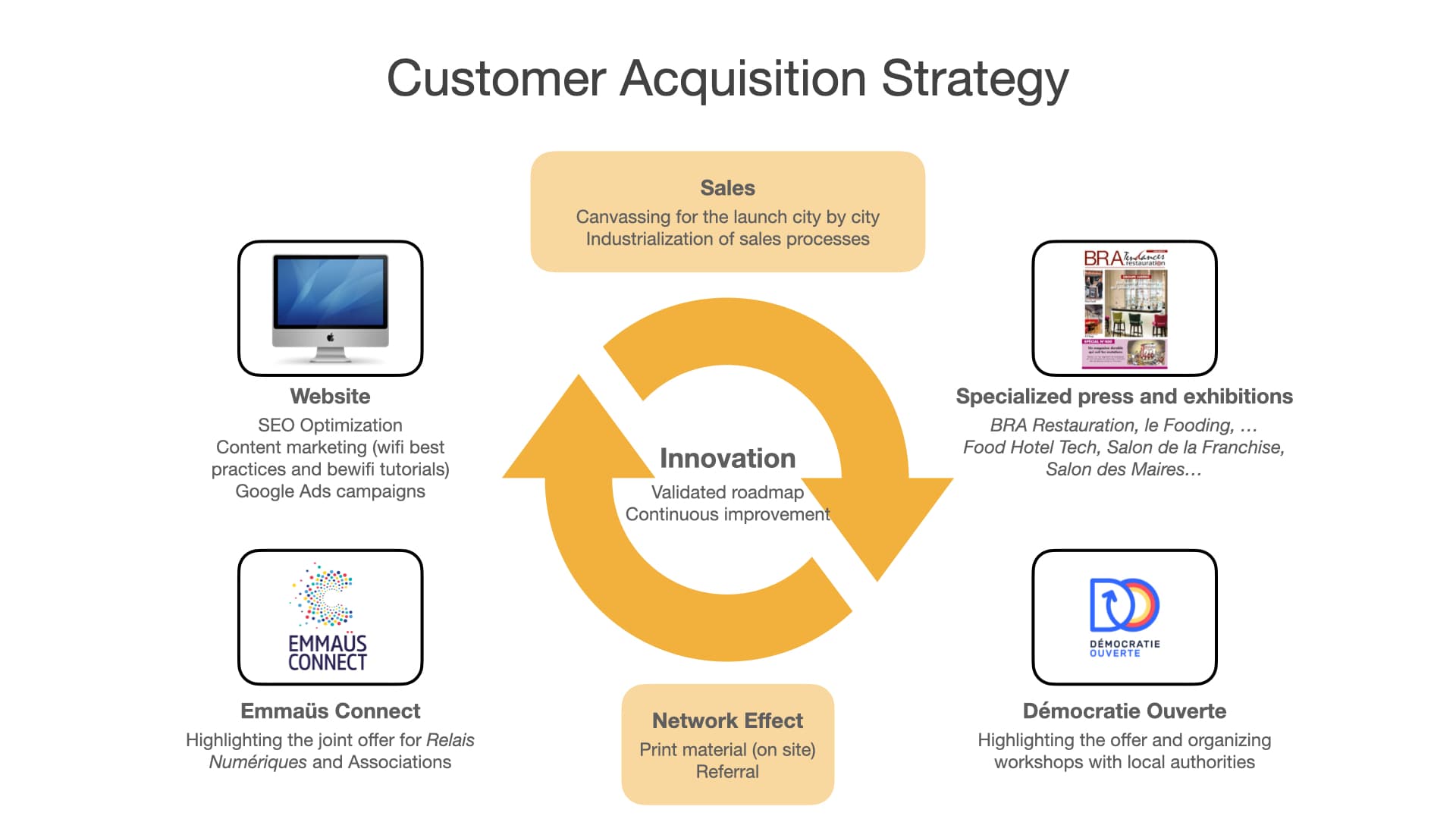

Pour le moment nous sommes les seuls à proposer ce type d'offre et de technologie aux professionnels sur le marché.

Comme de nombreux acteurs du web, nous allons de toute façon devoir continuer d'innover pour conserver notre avance.

Mais c'est ce qu'on aime, parce qu'il n'y a pas mieux que d'innover pour le bien commun ! 🙂

No.B.: over time, new risks may emerge and those presented may evolve.

To receive our detailed business plan, contact us at contact@beacon-eggs.com

/ Comments /

Register Connexion